HSBC

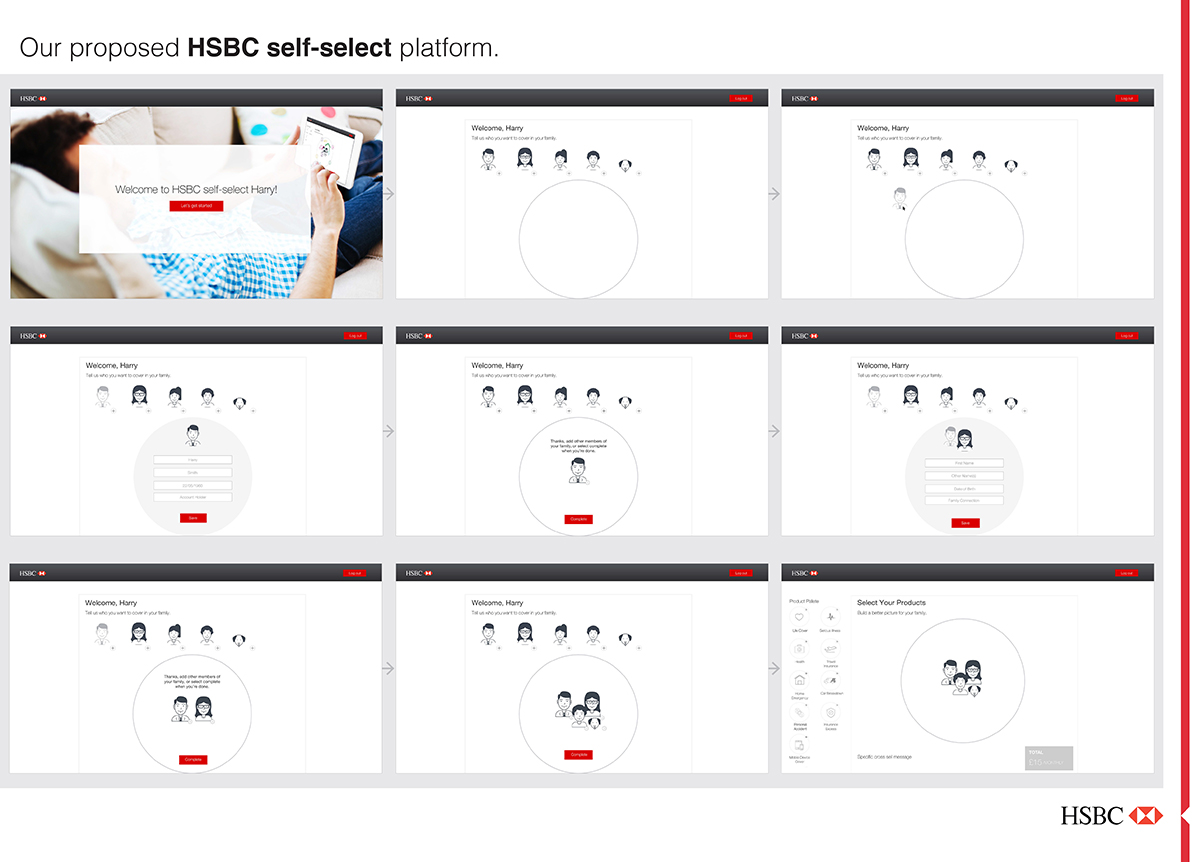

Insurance portfolio

As a client of Allianz, HSBC chose to reinvent their full insurance portfolio that consolidated their nine insurance products into one solution, from one insurer. Allianz’ response was to create an offering that encompassed the service as a friendly way to protect loved ones in a creative, simple solution.

My role

Creative, UI/UX Designer

Involvement

Concept

Prototyping

UI Design

Low fidelity mock-ups

Duration

2 weeks

Team

Digital Marketing

Creative

Business Development

A small brief

For a multi-million pound contract

The creative team was approached to produce a concept for the customer-facing platform that could be HSBC’s insurance platform. We had a tight timeframe to translate the brief into an idea that represented how insurance can be blended into the person’s life and humbly adapts to their ever-changing world.

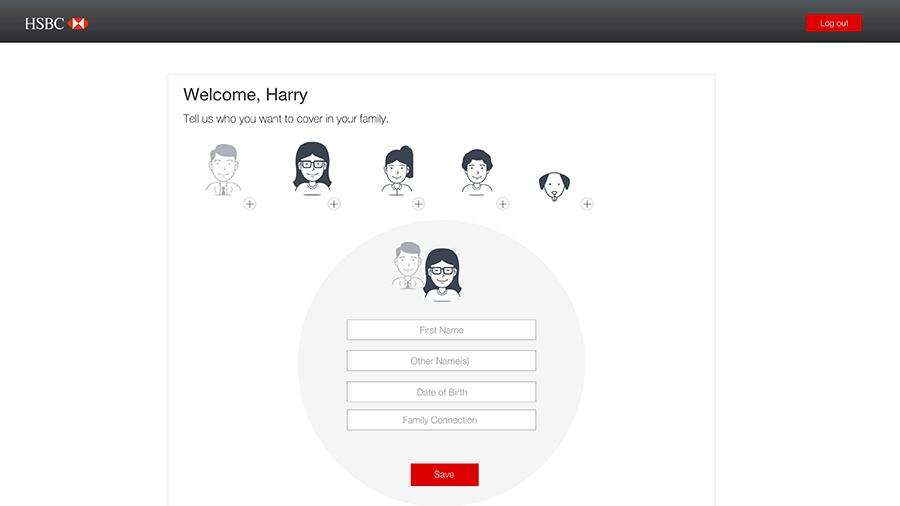

We went away as a team to explore gamification and personalisation that were mentioned in the creative brief and worked with the idea of creating a caricature that could be modified by the customer to represent themselves; inspired by Nintendo Wii character avatars.

Research

Customer-centred, literally

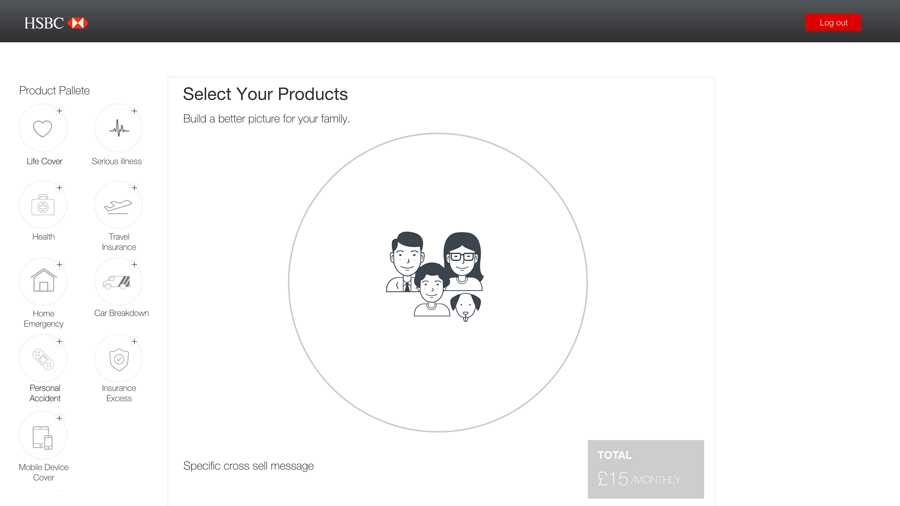

We recognised that when people choose their favourite products, each person is different, and therefore choices vary.

When you go to the cinema and buy Pick n Mix sweets; everyone’s preference is different.

If you ask a person what it is that means the world to them; more often than not they’d say their family, if not their health, their happiness and wellbeing. We took this idea and made it the centre-piece of our designs.

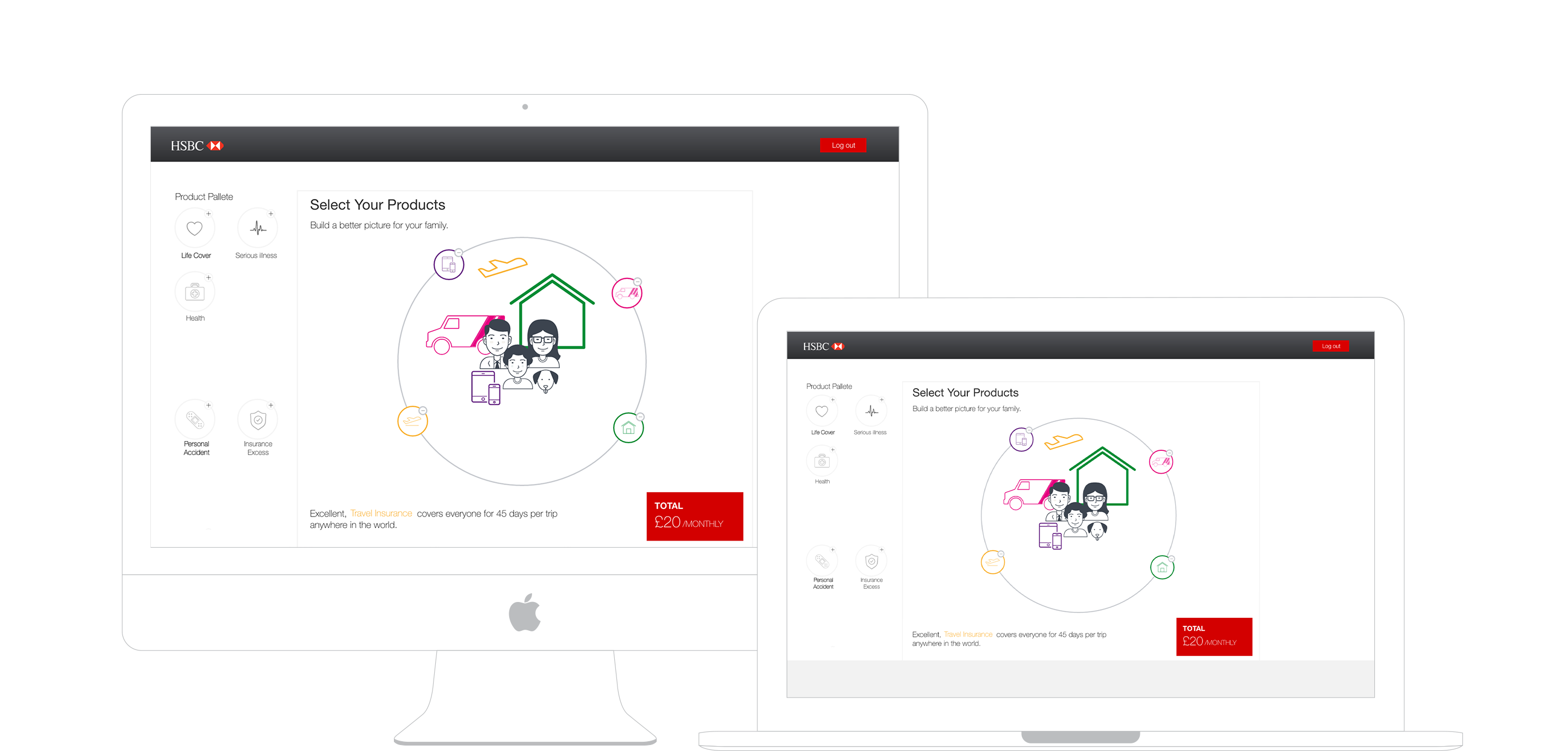

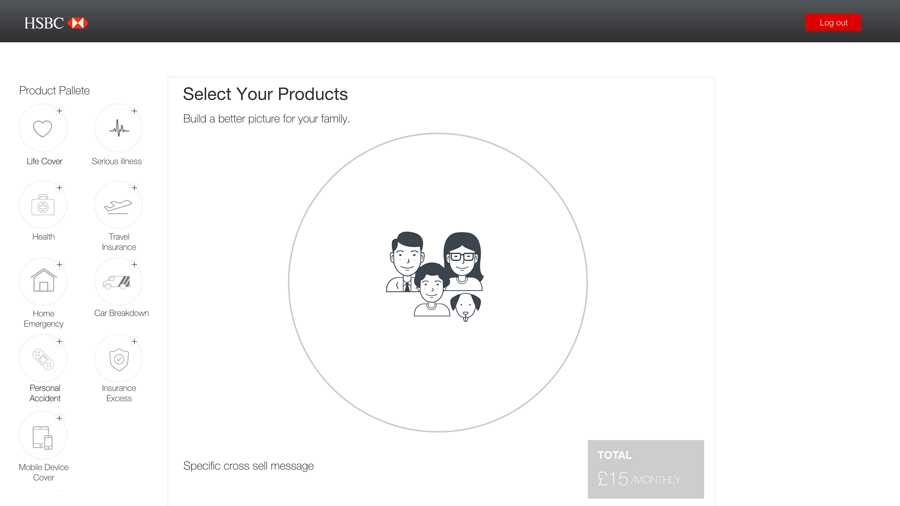

Solution

We produced a Pick ‘n’ Mix style system that allowed a customer to create their family, add information about each member to a level they felt comfortable and tailor all their insurance options to create a family portrait around them. We designed the system allowing the customer to switch on and off insurances depending on the month ahead - giving them value for money and empowering the customer in a way most insurance policies don't.

Every interface was designed to keep the user and their family at the centre of everything (their world). With the insurances surrounding them, providing layers of protection. If the items the customer cared about most are protected, then we are protecting their happiness and wellbeing.

Take Harry. Harry told us about his family - his wife Sarah and children Reuben and Sofia.

Harry’s family dog, Lucky, is four years old and is often put into kennels while Harry and the family are away on their trips to Italy and Portugal this year.

As a result, Allianz, the insurer knows that Lucky is going to be in kennels for at least two weeks, and can offer a product that adapted to this, such as on-call veterinary service should Lucky fall ill while the family is away.

However, Harry doesn’t have to do this manually; he tells Allianz he’s going to be away by switching on the holiday alert. Automatically the car insurance premium will reduce as it's known Harry won’t be driving, and his house and contents insurance will be put on alert.

So if there are flood warnings back at home while Harry’s on the beach, Harry will be told if there’s an issue and the insurer (assistant) can be proactive to make sure everything is ship-shape when he returns.

As a result, Allianz, the Insurer knows that Lucky is going to be in Kennels for at least two weeks, and can offer a product that adapted to this, such as on-call veterinary service should Lucky fall ill while the family is away.

But Harry doesn’t have to do this manually; he tells Allianz he’s going to be away by switching on the holiday alert. Automatically Car Insurance premium will reduce as we know he won’t be driving, and his House and Contents Insurance will be put on alert.

Harry is also notified just before Reuben’s 17th birthday (not only as a reminder) that he could add him to the families Car Insurance and Breakdown Cover, in case Reuben’s thinking of learning to drive. Reuben’s progress can then be tracked using in-car telematics, not only to see how he’s improving but also to bring down the cost of his car insurance as he gains more experience and becomes a better driver.

We produced low fidelity mock-ups, to suggest room for change; however, designed a prototype that could be used by the members of HSBC's insurance in the RFP, accompanied by a video presenting the idea.

Rodney, you plonker!

This time next year, you'll be out of date again, but for now, your browser to view this website correctly. Update my browser now